Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Saturday, 5 November 2022 00:00 - - {{hitsCtrl.values.hits}}

|

John Keells Holdings Chairperson Krishan Balendra

|

Premier diversified blue-chip John Keells Holdings PLC (JKH) yesterday urged the Government to ensure proper balance between economic stability and growth as it shores up efforts to boost tax revenue.

The call for judicious balance is whilst recognising positive progress made by the Government thus far in implementing the reforms and initiatives needed for fiscal consolidation to help overcome the financial crisis.

“We urge the authorities to give due consideration to ensuring tax measures are implemented with a view to striking a balance between economic stability and growth, which can, in turn, affect revenue targets if the base levels of activity are impacted significantly,” JKH Chairperson Krishan Balendra said in his review accompanying the company’s 2Q interim results released yesterday.

“While revenue enhancing measures are required, Government expenditure should also be optimised to drive economic recovery in a sustained manner,” he emphasised.

JKH Chief noted that the severe pressures on the domestic macro-economy as a result of external pressures have now eased somewhat and will be a positive heading into the ensuing quarter.

“While many fiscal tax consolidation measures have been announced and partly implemented, the impact of these measures on consumer disposable incomes and spending is yet to be fully seen,” he added.

Balendra said JKH is optimistic that Sri Lanka is on a path to recovery, and appreciated the authorities undertaking difficult, yet necessary, corrective measures to revive the economy to overcome the worst economic crisis faced by the country.

“We urge the authorities to expedite the implementation of much needed public sector reforms, as done by countries when faced with similar challenges in the past, to address the structural and governance issues of the economy to achieve long-term sustainable growth and emerge from this crisis stronger,” Balendra said.

Notwithstanding recommendations on the way forward, JKH yesterday announced strong performance in the FY232Q notwithstanding the challenging operating environment.

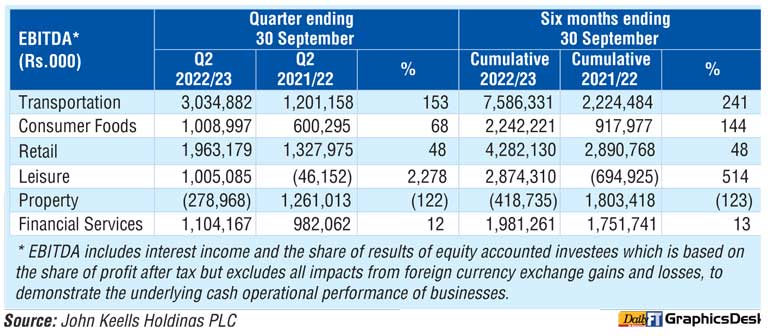

All businesses, except for the Property industry group, recorded an increase in profitability, particularly the Transportation businesses and the continued significant turnaround in the Leisure businesses driven by the Maldivian Resorts segment.

“It was encouraging to witness a quarter of operations with day-to-day consumer and business activity reverting to levels of normalcy from late July 2022 onwards, supported by political and social stability and less disruptions on account of the macro-economic challenges,” JKH Chairperson Krishan Balendra told shareholders in his review along with the company’s interim results.

Group revenue rose 40% to Rs.69.06 billion in FY232Q whilst Earnings Before Interest Expense, Tax, Depreciation and Amortisation (EBITDA) improved by 45% to Rs. 9.29 billion during the quarter under review demonstrating the strong underlying cash operational performance of the Group.

While the 2Q of the previous year was partially disrupted on account of the lockdowns due to the pandemic, the overall operating indicators in most businesses demonstrated activity at pre-pandemic levels.

Group PBT declined by 10% to Rs. 2.56 billion mainly on account of the second quarter of the previous year including revenue and profit recognition from the handover of the residential apartment units at ‘Cinnamon Life’, and the higher finance expenses due to the significant increase in interest rates on working capital facilities, particularly in the Leisure and Retail industry groups.

The PBT of the Holding Company was impacted by the translation impact of the IFC loan interest payment and the notional non-cash interest charged on the convertible debentures issued to HWIC Asia Fund (HWIC) in August 2022, in line with the accounting treatment, due to significant difference between the market interest rates and the three% interest accrued on the instrument.

In August 2022, the Government gazetted regulations under the Casino Business (Regulation) Act of 2010 to formalise the process of issuing of licences and monitoring of operations for casinos in Sri Lanka.

With the regularising of gaming, the Group will proceed with finalising arrangements with prospective gaming operators to operate at ‘Cinnamon Life’. Similar to the experience with Integrated Resorts in other Asian countries, ‘Cinnamon Life’ has the potential to transform Colombo as a destination for leisure and entertainment and lead to significant foreign exchange earnings for the country.

The profitability of the Transportation industry group recorded an increase driven by the Group’s Bunkering business, which recorded higher margins, and the Group’s Ports and Shipping business, where both businesses benefitted from the translation impact due to the depreciation of the rupee against the previous year.

The Leisure industry group recorded a continued turnaround in performance primarily driven by the Maldivian Resorts segment, supported by higher occupancy.

The Consumer Foods industry group continued its recovery momentum with the Beverages and Frozen Confectionery businesses recording growth in volumes.

The performance of the Supermarket business was driven by growth in same store sales through a combination of higher basket values on account of inflation and an increase in customer footfall.

The Property industry group recorded a decline in profitability as the second quarter of the previous year included revenue and profit recognition from the handover of the residential apartment units at ‘Cinnamon Life’. The recognition of revenue of all units sold at ‘Cinnamon Life’ up to 31 March was recorded across 2021/22.

The Insurance business recorded a growth in gross written premiums whilst Nations Trust Bank PLC recorded an increase in net interest margins and a reduction in costs.

In the first half of FY23, JKH Group revenue was up 64% to Rs. 133.4 billion, pre-tax profit was up 319% to Rs. 17.3 billion and after tax by 239% to Rs. 13.1 billion. Net profit attributable to equity holders of the parent was up 193% to Rs. 12.88 billion.