Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 17 August 2021 02:34 - - {{hitsCtrl.values.hits}}

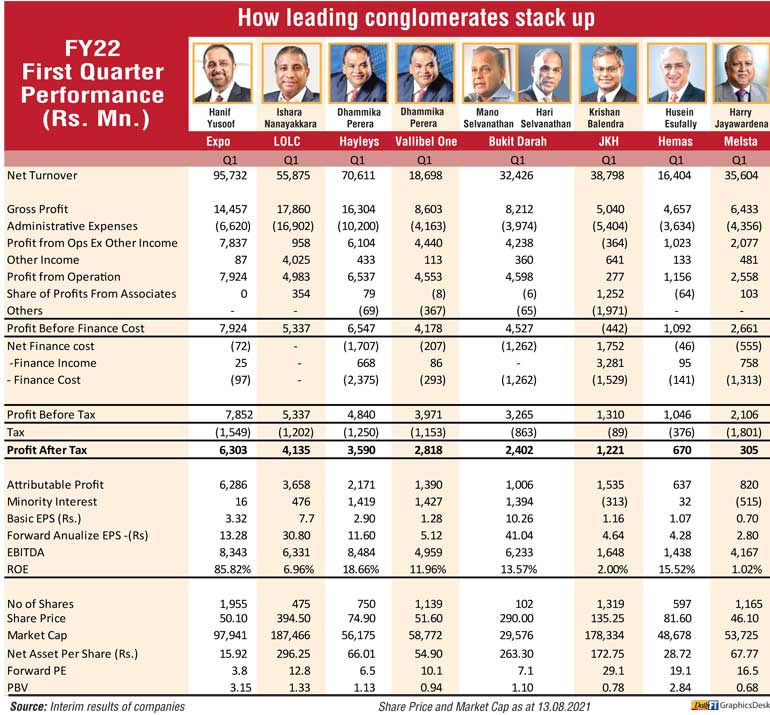

The top eight conglomerates posted a combined pre-tax profit of Rs. 30 billion in the first quarter after generating Rs. 364 billion in net revenue.

The performance in the latest quarter was stellar in comparison to a year ago, which saw the first wave of the COVID-19 pandemic. On a quarter-on-quarter basis too, the performance of some of the conglomerates was impressive.

The combined after-tax profit was over Rs. 21 billion while the collective tax paid was Rs. 8.3 billion.

Logistics star Expolanka Holdings leads the pack in both turnover and profits, a development which has made it the most sought-after stock in the Colombo bourse, propelling its market value.

Whether Group CEO Hanif Yusuf-led Expolanka will continue to lead in performance in the remaining quarters of FY22 remains to be seen, but diehard fans of the Group believe it will deliver.

Last year's star Ishara Nanayakkara-controlled LOLC comes second in terms of after-tax profit, though in at profit before finance cost, Hayleys was a clear second. The Selvanathan family-controlled Bukit Darah was fourth.

In terms of earnings before interest, taxes, depreciation, and amortisation (EBITDA), Hayleys is number one with Rs. 8.48 billion, with Expo trailing with Rs. 8.34 billion, LOLC third with Rs. 6.33 billion and Bukit Darah fourth with Rs. 6.23 billion. EBITDA is a useful metric to evaluate an entity’s operating performance and is considered a proxy for cash flow from the entire operations.

If Dhammika Perera's two listed business empires – Hayleys and Vallibel One – are combined, he is a clear leader with Rs. 8.3 billion in pre-tax profit and Rs. 6.4 billion in after-tax profit. In terms of taxes paid, the combined value is Rs. 2.4 billion, accounting for near 30% of the top eight's total.

However, in terms of bottom line (profit attributable to parent) Hayleys and Vallibel combined is lower than Expo and LOLC individually.

Cash-rich John Keells Holdings (JKH) enjoyed the highest finance income of Rs. 3.2 billion whilst net finance cost was a positive Rs. 1.7 billion, thereby helping its profitability. It also saw a rebound continuing in 1Q though impacted by the leisure sector, a development which most in the top eight witnessed. Analysts say the challenge before JKH is to regain its lost glory as the once premier blue chip, though it remains as foreign portfolio investors’ proxy to the Colombo stock market.

Harry Jayawardena-controlled Melstacorp PLC, which is the holding company of Aitken Spence and Distilleries among others, and Esufally-family owned Hemas make up the rest of top eight.

Softlogic Holdings, which figured in the Daily FT’s previous analysis, hadn't released interim results as of 13 August 2021.

Richard Peiris and Company, another conglomerate, was left out based on smaller turnover, but its bottom line (Rs. 1 billion) in 1Q was higher than both Hemas and Melstacorp. There were few other diversified entities whose after-tax profit and bottom line were higher as well.