Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 15 October 2019 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka’s trade deficit contracted by $ 2.3 billion to $ 4.8 billion during the first eight months of this year, the Central Bank said yesterday, with August seeing an import decline of 16.6% while exports declined by 0.4%.

The deficit in the trade account contracted by $ 2,386 million to $ 4,854 million during the first eight months of 2019, in comparison to $ 7,240 million in the corresponding period of 2018, the Central Bank said in its latest External Performance report.

The trade deficit contracted in August 2019 as the decline in imports continued while the dip in exports in the previous month has largely recovered. Import expenditure recorded a decline of 16.6% (year-on-year) and export earnings declined fractionally by 0.4% (year-on-year) in August 2019, mainly due to the lower prices of major export categories.

The trade deficit fell to $ 540 million in August 2019 compared to the deficit of $ 717 million recorded in July 2019.

Meanwhile, the terms of trade, which represents the relative price of imports in terms of exports, improved by 5.2% (year-on-year) as import prices reduced at a faster pace than the reduction in export prices. However, on a cumulative basis, the terms of trade deteriorated marginally by 0.1% during the first eight months of 2019 in comparison to the corresponding period of 2018.

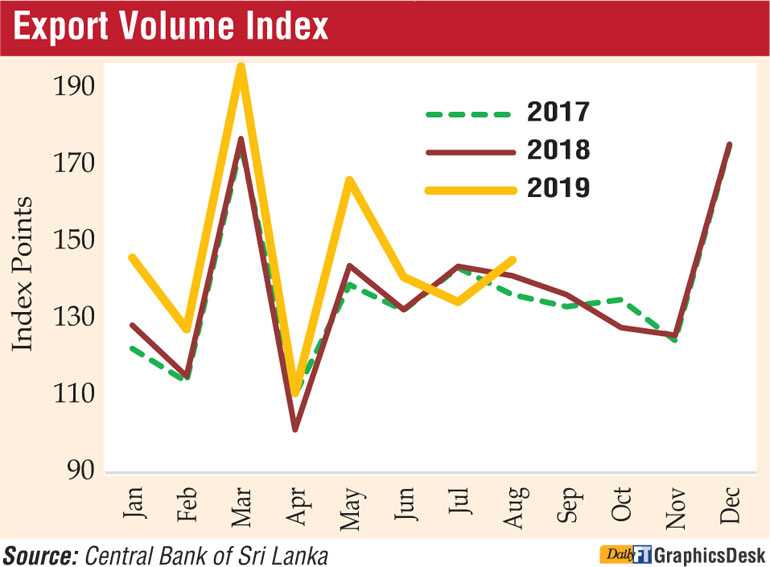

Earnings from merchandise exports declined marginally by 0.4% (year-on-year) to $ 1,033 million in August 2019, led by a decline in agricultural exports followed by mineral exports while industrial exports grew, supported by higher earnings from textiles and garments. Earnings from textiles and garments increased by 7%, reflecting the higher demand from all major markets especially from the European Union, which recorded a growth of 12.9%.

Export earnings from chemical products, printing industry products, animal fodder and plastics and articles thereof also increased. However, export earnings from rubber products declined due to lower earnings from tyres and surgical and other gloves exports while food, beverages and tobacco exports declined with lower exports of vegetable, fruit and nut preparations as well as manufactured tobacco. Export earnings from machinery and mechanical appliances, petroleum products, transport equipment, base metals and articles and leather, travel goods and footwear also declined during this period.

Earnings from agricultural exports decreased in August 2019 due to lower earnings from all sub-categories except tea, seafood and vegetables.

Earnings from tea exports increased in August 2019 due to higher export volumes despite the decline in average export prices. However, earnings from spices declined due to poor performance in cinnamon, clove and pepper. In addition, export earnings from coconut declined due to lower export prices in both kernel and non-kernel products.

Export earnings from mineral exports also declined in August 2019 in comparison to August 2018 due to a low performance in all sub-categories under mineral exports. The export volume index in August 2019 increased by 2.9% (year-on-year) while the export unit value index declined by 3.2%, indicating that the subdued performance of exports was entirely driven by the reduction in export prices.

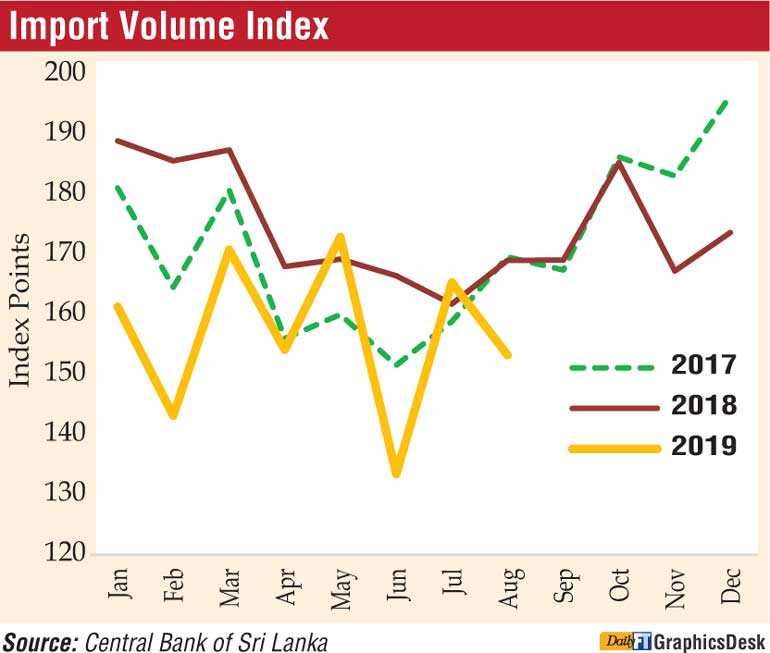

Expenditure on merchandise imports contracted notably in August 2019 for the tenth consecutive month by 16.6% (year-on-year) to $ 1,574 million, registering a decline across all major categories of imports.

Expenditure on consumer goods imports declined in August 2019, reflecting the reduction in both food and beverages and non-food consumer goods imports. Lower imports of spices, dairy products, vegetables and seafood mainly contributed to the decline in imports of food and beverages while lower imports of personal motor vehicles resulted in the contraction in non-food consumer goods imports.

“Import expenditure on personal motor vehicles declined by 46.2%, year-on-year, continuing the trend observed since December 2018 despite an increase seen in July 2019 over the preceding months, reflecting the impact of a backlog of concessionary permits being used for importing vehicles.”

However, expenditure on sugar and confectionary, medical and pharmaceuticals, cereals and milling industry products imports has increased during August 2019.

Expenditure on imports of intermediate goods reduced in August 2019 mainly due to lower expenditure on petroleum products as a result of lower import volumes and prices. Expenditure on textiles and textile articles, chemical products, paper and paperboard and articles thereof and mineral products also declined. However, expenditure on fertiliser imports increased more than twofold on a year-on-year basis in August 2019 due to higher volumes imported targeting the coming Maha season while the import of base metals, wheat and maize also increased.

Imports of investment goods declined in August 2019 due to lower imports of machinery and equipment and building material. However, transport equipment increased significantly, driven mainly by the importation of railway equipment. The import volume index dropped by 9.3% while the unit value index dropped by 8%, indicating that the decline in imports was driven by the combined effect of lower volume and prices when compared to August 2018.

Foreign investments in government securities recorded a net outflow of $ 156 million in August 2019. On a cumulative basis, net outflows from the government securities market amounted to $ 285 million during the first eight months of the year.

Foreign investments in the Colombo Stock Exchange (CSE), including primary and secondary market transactions, recorded a net outflow of $ 12 million during August 2019. Nevertheless, financial flows to the CSE recorded a net inflow of $ 22 million during the first eight months of 2019.

Further, long-term loans to the Government recorded a net inflow of $ 83 million during August 2019. There were significant project loan inflows to the Government in August 2019, with a number of social development and infrastructure projects receiving disbursements.

Gross official reserves stood at $ 8.5 billion by end August 2019, equivalent to 5.1 months of imports. Meanwhile, total foreign assets, which consist of gross official reserves and foreign assets of the banking sector, amounted to $ 11.3 billion as at end August 2019, which was equivalent to 6.8 months of imports.