Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 8 April 2025 03:43 - - {{hitsCtrl.values.hits}}

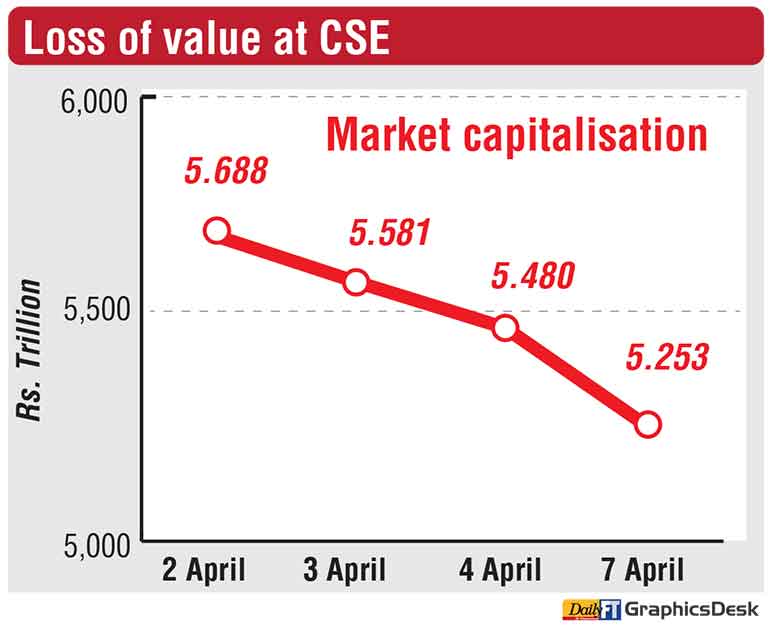

The disastrous 44% tariff on Sri Lankan products announced by US President Donald Trump last week had its full effect among investors yesterday, as the Colombo stock market suffered a trading suspension and has lost nearly Rs. 500 billion in value during the past three sessions.

The benchmark ASPI declined by 4.6% or 712 points and the active S&P SL20 plunged by 6%.

The latter’s dip of 5% earlier in trading saw a temporary market halt.

The Colombo Stock Exchange (CSE) saw its value worth Rs. 227 b being wiped out since President Trump’s announcement, whilst Rs. 435 billion in value had been wiped out in just three days. Consequent to yesterday’s crash, the ASPI’s year-to-date negative return expanded to over 8%, and that of the S&P SL20 to over 12%.

The CSE’s performance more or less mirrored the sell-off in global markets yesterday.

Turnover yesterday at the CSE was Rs. 6.47 billion involving 188.3 million shares. Turnover was led by DIMO (Rs. 953 million), JKH (Rs. 929 million), SAMP (Rs. 626 million), and HNBN

(Rs. 606 million).

First Capital said global equity markets, particularly in Asia, endured a dramatic sell-off, with some analysts dubbing it a “bloodbath,” in response to the newly unveiled tariff scheme by the US.

The CSE mirrored this route, with the ASPI plunging sharply during the early session, propelled by panic-driven sell-offs. In fact, trading was suspended for 30 minutes as the S&P SL20 tumbled over 5%, triggering the circuit breaker mechanism. By the close, the ASPI finished at 14,660, a staggering loss of 713 points reflecting a 4.6% decline. The Banking sector was the primary catalyst behind the downturn, with COMB, HNB, and SAMP leading the negative charge, compounded by significant declines in MELS and JKH.

Turnover rose on the back of panic-selling, set off particularly by retail investors. This marks a substantial uptick from the monthly average of Rs. 2.3 billion. The Banking sector dominated contributions to turnover with a share of 32%. This was followed by the Capital Goods sector and the Retailing sector, which produced a joint contribution of 38%.

Asia Securities said the market commenced the week on a downbeat note amid heavy selling pressure, leading to a sharp drop in both key indices. The decline in the S&P SL20 index triggered the 5% circuit breaker, resulting in a 30-minute trade halt during the early hours. Although the market saw a marginal pickup after the halt was lifted, the recovery momentum failed to sustain as heavy selling pressure resumed, particularly in heavyweight stocks.

The dip in indices was primarily led by Banking sector counters. Notable price declines in COMBN (-8.6%), HNBN (-8.0%), NDB (-7.3%), PABC (-6.4%), and SAMP (-5.9%) were recorded during the session. Moreover, DIPD (-8.5%), LOLC (-6.6%), AEL (-6.0%), and BIL (-5.6%) closed in the red, leading to a broad-based decline during the session. COMBN (-65 points) ended as the biggest dragger on the ASPI, followed by HNBN (-59 points), SAMP (-44 points), MELS (-36 points), and JKH (-35 points). The breadth of the market was negative, with 19 price gainers and 220 decliners.

Foreigners recorded a net inflow of Rs. 300.3 million. Net foreign buying topped in BUKI.N at Rs. 172.8 million and selling topped in JKH at Rs. 165 million.

NDB Securities said high net worth and institutional investor participation was noted in Diesel & Motor Engineering, John Keells Holdings, and Teejay Lanka. Mixed interest was observed in Sampath Bank, Hatton National Bank, and Commercial Bank, whilst retail interest was noted in RIL Property, LOLC Finance, and Raigam Wayamba Salterns.

The Banking sector was the top contributor to the market turnover (due to Sampath Bank, Hatton National Bank, and Commercial Bank) whilst the sector index lost 6.81%. The share price of Sampath Bank moved down by Rs. 6.50 to Rs. 102.75. The share price of Hatton National Bank recorded a loss of Rs. 23.25 to Rs. 269.00. The share price of Commercial Bank declined by Rs. 11.50 to Rs. 122.50.

The Capital Goods sector was the second highest contributor to the market turnover (due to John Keells Holdings) whilst the sector index decreased by 4.63%. The share price of John Keells Holdings lost Rs. 0.90 to close at Rs. 18.70.

Diesel & Motor Engineering was also included amongst the top turnover contributors, with its share price decreasing by Rs. 13.25 to Rs. 956.75.