Thursday Feb 19, 2026

Thursday Feb 19, 2026

Saturday, 30 May 2015 01:56 - - {{hitsCtrl.values.hits}}

Finance Minister and Central Bank Chief say successful conclusion of $ 650 million 10-year sovereign bond and $ 338 m SL Development Bond issues confirm global investor confidence in new regime

Finance Minister Ravi Karunanayake (right) and Central Bank Governor Arjuna Mahendran at yesterday’s media briefing on the new Government raising nearly $ 1 billion in a day - Pic by Lasantha Kumara

Finance Minister Ravi Karunanayake (right) and Central Bank Governor Arjuna Mahendran at yesterday’s media briefing on the new Government raising nearly $ 1 billion in a day - Pic by Lasantha Kumara

By Charumini de Silva

The Government yesterday revealed that it had raised nearly $ 1 billion (Rs. 135billion) dollars in a day at competitive rates as an emphatic vote of confidence from the investor community, bolstering its resolve to govern better.

On Thursday, via a 10-year international sovereign bond, the Government raised $ 650 million and on the same day $ 338 million was raised via the local Sri Lanka Development Bonds issuance. Combined fundraising was at a weighted average cost of 5.261% per annum.

“The successful conclusion of the two bond issues is a reflection of the investor confidence placed in the country,” Finance Minister Ravi Karunanayake told journalists at a briefing where he was seated alongside Central Bank Governor Arjuna Mahendran.

Karunanayake said with the infusion of the $ 988 million into the country’s foreign reserves would reach $ 8.3 billion shortly and the aim is to strengthen it further to $ 9 billion, which will be an all -time record.

“We are trying to push further where we would be able to get into the $ 9 billion range and ensure that we give the people what they basically deserve from a good government,” the Finance Minister added.

“We are pushing the interest rates downward further internally and externally. We are trying to reduce the debt servicing ratios as far as possible by way of reducing the tenure rates and interest rates and pass on the benefit to the people,” Karunanayake emphasised.

When asked how challenging it was to launch International Sovereign Bond Issue, Central Bank Governor Arjuna Mahendran said: “It was not difficult at all. The reason we delayed it was because we wanted to develop our local bond market. We wanted to see that Sri Lankans would get the full benefit of the Government’s borrowing program.”

Justifying the reason for launching the bond now, he said that they already had appointed four lead managers in December last year.

“We thought at this moment in time it would be also a good time to tap the international markets because it is expected that the US Central Bank is going to raise interest rates in the near future. Hence, before the interest rates move further, we thought we will lock in some dollar funding at this point of time because the time was good,” Mahendran said.

He said that they opened the borrowing bond auctions on 27 February 2015 and added that they subsequently raised record amounts of money.

“Now just yesterday we raised $ 338 million in one day. Dollars auctioned in Sri Lanka — that is the first time it has ever happened on this magnitude. In the rupee markets we have raised as much as Rs. 100 billion in one week

through our auctions,” the CB Chief added.

The Governor also said that by moving to an auction system they have signalled to Sri Lankans and to the rest of the world that Sri Lanka is open for business. “We have proved that this is not a place for private placements and private backroom deals and that has boosted global investor confidence and immediately benefitted the economy,” Mahendran added.

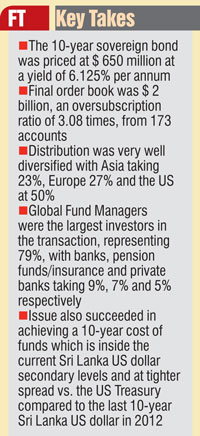

The 10-year sovereign bond was priced at $ 650 million at a yield of 6.125% per annum.

The Issue represented the eighth US Dollar benchmark offering in the international bond markets by Sri Lanka since 2007.

Citigroup Global Markets Inc., Deutsche Bank, The Hongkong and Shanghai Banking Corporation Limited and Standard Chartered Bank acted as Joint Lead Managers/Bookrunners on the transaction.

Fitch Ratings, Moody’s Investors Service and Standard and Poor’s have rated the Issue at ‘BB-’, ‘B1’ and ‘B+’ respectively.

The issue was announced during the Asia morning on 28 May 2015 with an initial price guidance of 6.375% per annum. The order books grew steadily, allowing Sri Lanka to price the issue at a yield of 6.125% or a spread of 397.7 bps vs. the 10-year US Treasury.

“The compression in yield of 25 basis points reflects the continued confidence that the international investors have placed in the sovereign bond issuance of Sri Lanka,” Central Bank said.

“The final order books stood at $ 2 billion, an oversubscription ratio of 3.08 times, from 173 accounts,” it added.

Distribution was very well diversified, with Asia taking 23%, Europe 27% and the US at 50%. Global Fund Managers were the largest investors in the transaction, representing 79%, with banks, pension funds/insurance and private banks taking 9%, 7% and 5% respectively.

The Central Bank said that with this transaction, this issue represents the first Sovereign Bond Issue for Sri Lanka in the international capital markets in 2015, after the change in Government.

“This issue also succeeded in achieving a 10-year cost of funds which is inside the current Sri Lanka US dollar secondary levels and at tighter spread vs. the US Treasury compared to the last 10-year Sri Lanka US dollar in 2012. This achievement is all the more impressive, given the recent volatility in US Treasury yields and anticipated Fed rate hike later this year,” the Central Bank added.