Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 17 February 2020 00:06 - - {{hitsCtrl.values.hits}}

By Asia Securities Ltd.

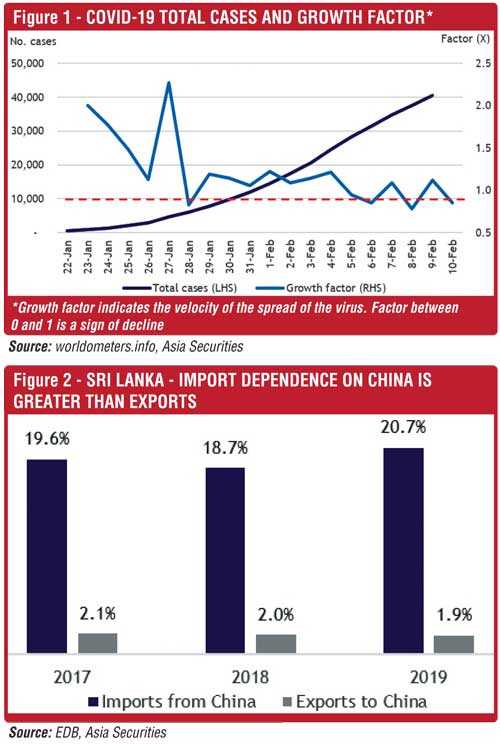

The World Health Organisation (WHO) recently declared the 2019 novel-coronavirus (COVID-19) a global health emergency. As of 11 February, the highly contagious virus has spread to 26 countries, with over 43,000 reported cases. While the coronavirus’ mortality rate appears to be relatively low (2% for COVID-19 vs. 10% for the 2003 SARS epidemic), the death toll of over 1,000 in six weeks has already surpassed that of SARS (774 deaths over eight months). China has initiated a lockdown of affected areas, and several countries have rolled out quarantine processes or outright travel bans for Chinese travellers. However, we are now starting to witness a decline in the growth of the infection based on the latest observed new case data. Despite the drop in new case numbers, the ripple effects of the outbreak are expected to have an economic toll, with the global tourism industry sustaining the largest impact.

China returns to work, but partially; trade indicators have a factored-in slowdown

China’s economic surge over the last 40 years has cemented the world’s dependence on China as a manufacturing hub. China accounts for approximately 16% of global GDP now, compared to 4% in 2002-2003 during the SARS outbreak. The dependence on China’s industrial outputs and the impact of the outbreak on global supply chains means that global trade is likely to see a slowdown. The Baltic Dry Index (BDI)—the benchmark for dry-cargo shipping rates—and Drewry’s East-West Air Freight Price Index, which have seen a slump of 61.7% and 9.1%, respectively since January 2020, reflects this slowdown.

Following the outbreak, the Chinese Government delayed the re-opening of factories which were on break for the Chinese Lunar New Year till 10 February. As the outbreak coincided with the Chinese New Year holidays—when manufacturing is generally slow—it is expected that global buyers are expected to have maintained sufficient inventory, thus limiting the short-term impact. However, a continued loss of output from China could lead to a shortage of raw materials. While the risk is low, further delays in factory openings may also compel local importers to consider sourcing materials from alternative markets at a higher price.

Further delays in restarting operations in China could impact several sectors in Sri Lanka

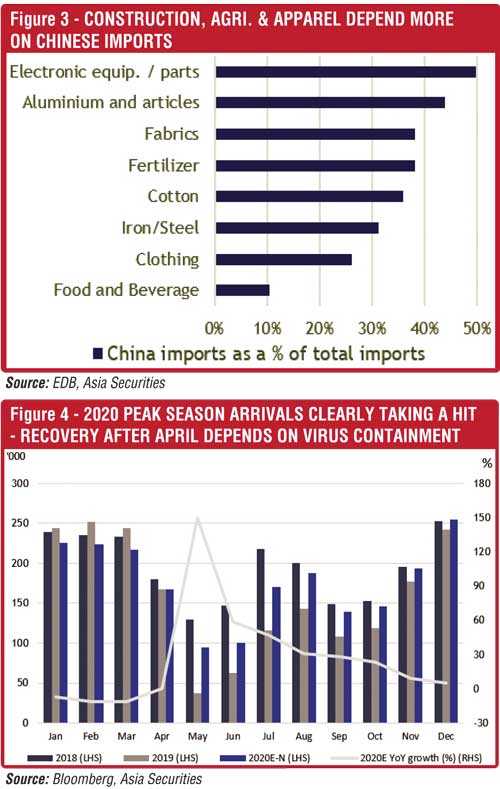

China remains a significant source of key raw materials for local industrial production and agriculture. As of end 2018, China was Sri Lanka’s second-largest source country for imports—just behind India—accounting for 18.5% of total imports.

The negative impact of COVID-19 comes in a year where there is a likelihood of higher import demand, primarily driven by consumers. Prolonged disruptions to consumer imports may drive up prices for non-essential goods which in turn may cause an uptick in overall inflation. However, this is an unlikely scenario as Indian imports are expected to fill most of this vacuum. A major concern on the trade front, however, would be the global impact of COVID-19 on key export destinations like the US and Europe. Preliminary estimates indicate that China’s growth could see a ~1.0% setback due to the outbreak, but more visibility is needed to assess the actual impact. With the International Monetary Fund’s (IMF) prediction of a global slowdown, the outbreak’s impact is expected to add further pressure on global demand for local exports. If manufacturing disruptions in China continue through February and March, sectors such as construction, apparel and agriculture will see a larger impact in the second quarter. From a consumption perspective, the largest impact would be on electronic equipment. The apparel sector’s—which accounts for 44.3% of exports from Sri Lanka—dependence on textile imports from China is relatively low. However, continued delays and shortage of textile imports may lead to medium-term weakness in the local apparel manufacturing industry.

Tourism to see the worst hit, again

Sri Lanka’s dependence on tourism has grown from 1.5% of GDP in 2012 to 4.9% in 2018. Sri Lanka’s ambitious plans to grow tourism earnings to $7.0 billion by 2020 however, faced a significant setback following the Easter attacks. Coronavirus-related cancellations, which are focused around the second half of the peak season (January to March) will further delay the recovery of arrivals in 2020. Chinese tourists account for 8% in the arrivals mix, and this number is expected to drop sharply during the peak season. Chinese tourists to Sri Lanka generally comprise large groups who travel through agencies and use resort accommodation. Therefore, the resort segments in both Sri Lanka and the Maldives will see a significant impact in the coming months.

Consumer sector to see second-order impact from soft tourism

The impact will be mostly felt by companies exposed to clothing and electronics retailing and companies importing raw materials from China for local production. The slowdown in the local branded apparel business in the first quarter is attributed in part to the drop in Chinese tour groups that frequent local retail stores, and in part to cautious locals avoiding public places. The latter is reflected in the drop in footfall at locations such as One Galle Face, Colombo City Centre and the Odel store which have seen a notable slowdown over the past one to two weeks.

Slowing global trade and dropping freight rates may bring down the logistics sector

Logistics companies (especially those with heavy links to China) that are exposed to international logistics operations such as freight forwarding and shipping (agency operations) will see an impact on volumes from lower order volumes and impact on margins from volatility in rates.

Conclusion…for now

The first-order impact of the Coronavirus is clearly on tourism. In Sri Lanka, the tourism sector is expected to take a hit to its arrivals numbers during the peak January-March period. Asia Securities Research expects a 100,000 drop in arrivals compared its original 2020 estimate. Sri Lanka also depends on China for aluminium, fertiliser, fabrics, iron and steel, so production delays in China are likely to impact the local agriculture, construction and apparel sectors. As of end 2018, China was Sri Lanka’s second-largest import destination behind India, accounting for 18.5% of total imports. In terms of exports, the Chinese market accounted for 2% of market share in 2018.

The concern here is if delayed production could impact manufacturing as China exports raw materials for industrial production globally. A prolonged loss of output from China could lead to raw material shortages. However, on a positive note, we expect the recent drop in global oil prices to help lessen the burden on the trade balance during the first quarter of 2020. We cautiously await further case trend data in coming weeks to assess the risks to the outcomes predicted above.