Saturday Feb 28, 2026

Saturday Feb 28, 2026

Wednesday, 13 September 2017 00:00 - - {{hitsCtrl.values.hits}}

With the tourism boom in the recent post war period of Sri Lanka, there has been a considerable growth in the SME segment of accommodation providers. This growth has been possible primary due the strong presence of Online Travel Operators (OTAs) through whom these SMEs market their units. This paper endeavours to study the impact the global OTAs are having on the SME segment in a select area, and its overall impact for the Sri Lankan tourism industry

With the tourism boom in the recent post war period of Sri Lanka, there has been a considerable growth in the SME segment of accommodation providers. This growth has been possible primary due the strong presence of Online Travel Operators (OTAs) through whom these SMEs market their units. This paper endeavours to study the impact the global OTAs are having on the SME segment in a select area, and its overall impact for the Sri Lankan tourism industry

By S.S Miththapala and Sarah Tam

After the cessation of civil hostilities in 2009 in Sri Lanka, tourism has made great strides, with arrivals recording double digit YoY growth. From a mere 438,475 arrivals in 2009, Sri Lanka’s arrivals surpassed two million in 2016 (Sri Lanka Tourism Development Authority – SLTDA 2016 Statistical Report), more than a 400% increase over seven years. Foreign exchange earnings from tourism also reached a record $ 3.5 b, becoming the third largest foreign exchange earning sector of the national economy, after foreign remittances ($ 7.2 b) and textiles and garments ($ 4.9 b). (SLTDA 2016).

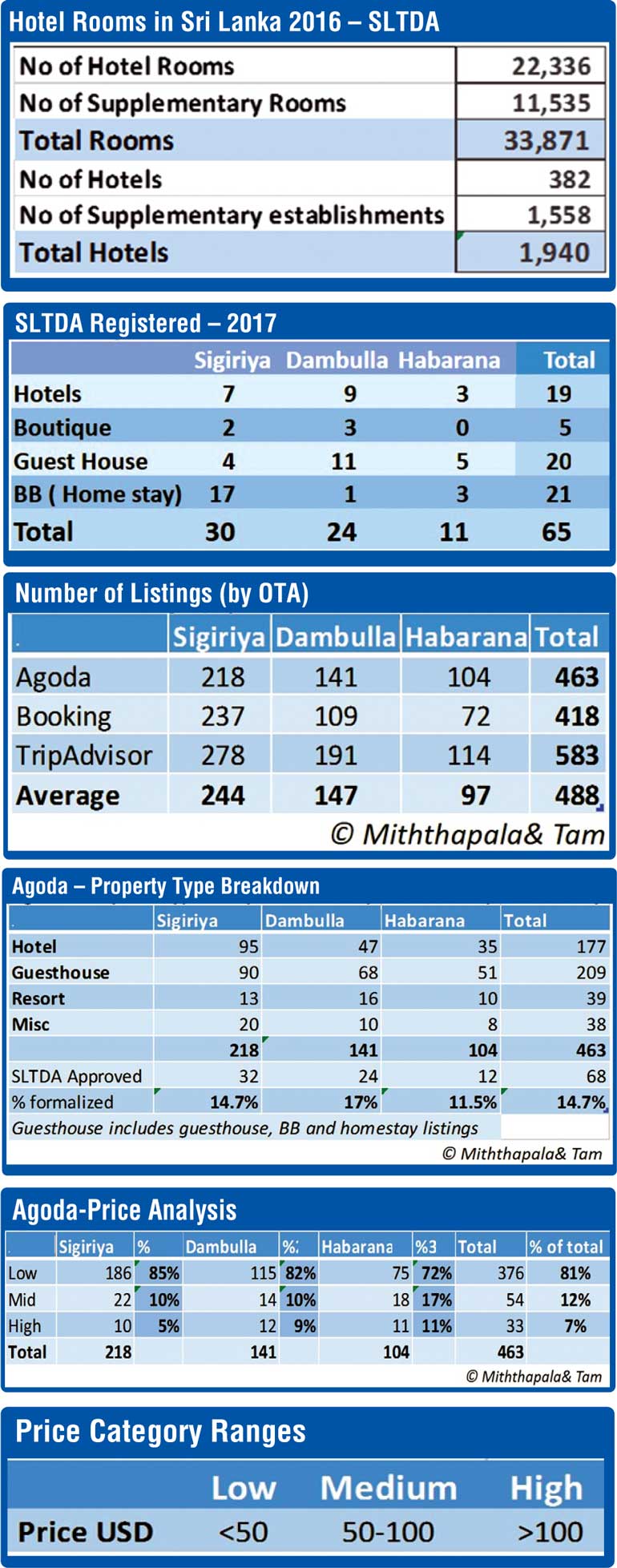

In keeping with this demand there have been large-scale hotel developments taking place in the country, with current room stock tourist hotels (Classified/Unclassified and Boutique Hotels) increasing by 2,960 rooms in 2016, from a total of 19,376 in 2015 to 22,336 in 2016. (SLTDA 2016.)

As is typical in an Asian environment, outside this formal sector there are a number of informal operators who provide tourism services, primary providing basic accommodation services mainly in some of the more popular tourism destination areas of the island. There is no reliable available information available about this segment.

However there appears to be a growing demand from visitors for these cheaper accommodation providers who offer a more authentic experience. In fact in a recent study published it was estimated that over 50% of all arrivals to Sri Lanka are patronising this informal sector (Miththapala S. S www.academia.edu/34154607 2017)

There is no doubt that the ability of these informal establishments to reach out and market themselves on their own has been solely due to the emergence of Online Travel Operators (OTAs) such as Agoda, Booking.com, Trip Advisor, et al. It appears that there is a preponderance of these informal establishments marketing themselves through these large-scale OTA aggregators.

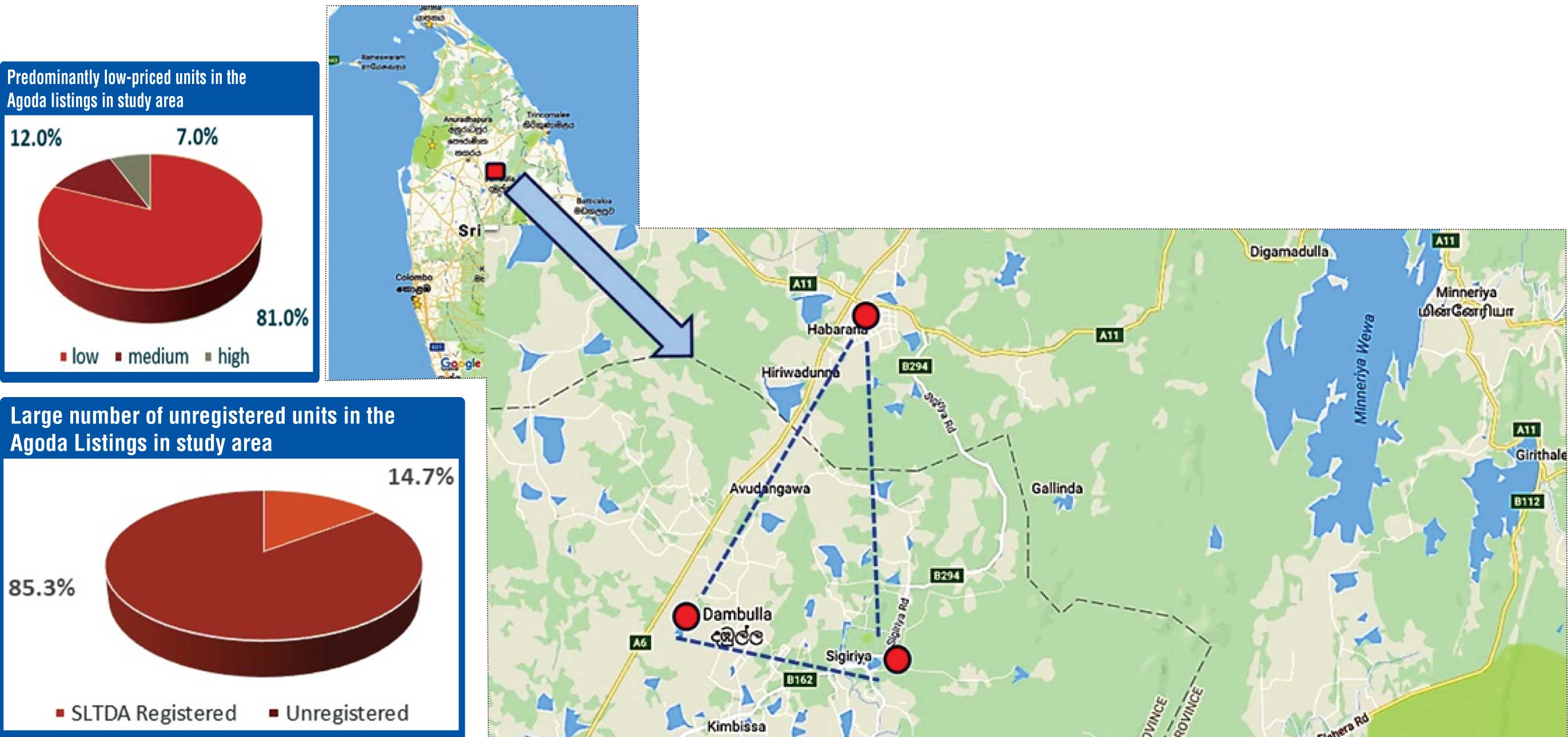

One of the more popular areas within the central cultural area of Sri Lanka comprises the Habarana, Dambulla and Sigiriya, where over the past few years there has been a veritable ‘explosion’ of these informal accommodation providers cropping up almost ‘at every corner of a street’.

Hence it was felt that studying the extent of penetration of the OTAs featuring accommodation providers in this area would yield some valuable insights into the SME sector’s impact on tourism in this area.

4.0 The prevailing classification of Sri Lanka’s accommodation sector

Over and above this, there is another totally unregulated sector which will be termed as Informal establishments. They are the smaller ‘mom & pop’ BB home stay units (the so-called ‘real informal’ sector), who are not registered with SLTDA, and operating completely outside the jurisdiction of any authority.

Hence the total SME sector should really be the registered ‘supplementary establishments’ with the SLTDA plus the real informal unregulated sector

The total number of SLTDA registered ‘graded’ hotels in 2016 was 382 with a room stock of 22,336 while the supplementary accommodation units were 1,558 accounting for 11,535 rooms. On this basis the total room stock of registered establishments is 33,871.

Analysis of the SLTDA approved accommodation units by location for the specific areas of the study reveals the following:

Agoda, TripAdvisor and Booking.com are three of the most commonly used OTA platforms for domestic and international tourism. Booking.com is typically considered as the largest OTA platform with approximately 1,408,202 listings in 212 countries.

In the study area, Agoda has a marginal advantage over Booking.com in terms of the number of properties listed online. Overall, the number of properties listed on Agoda and Booking.com are similar. Despite TripAdvisor showing the most properties in Sigiriya, Dambulla and Habarana, the researchers found several property duplicates among the three locations as well as missing information such as price and contact information.

As such, Agoda was chosen as the primary OTA with a sample size of 463 properties.

Booking.com information:https://www.cloudbeds.com/articles/analysis-of-major-online-travel-agencies-otas/

The Agoda listings were divided for analysis based on the property type.

A limitation of the study is that the type of property is selected independently by property owners so this breakdown is not a true reflection of official property types used by the SLTDA. For example, not all the hotels listed in Sigiriya on Agoda are a true representation of hotels by the traditional sense (number of rooms, staff, standards, etc.).

Another limitation is that each location had many smaller subcategories including tents and apartments. Because of the inconsistency of these property types between the three locations, as well as the lack of properties per listing type (i.e. tents and apartments), these listings were grouped together as misc.

Despite the limitations, the following inferences can be made:

For the purpose of this exercise an arbitrary scale of pricing categories was set (see table). Based on this categorisation all 463 Agoda listings were categorised (see table).

Within the study area, 81 of OTA listings are considered low price whereas 12% and 7% are considered mid and high priced. Sigiriya and Dambulla had the highest percentage of low priced establishments, 85% and 82% respectively.

Based on this pricing analysis, it is evident that most of properties in the Sigiriya-Dambulla-Habarana area are considered low-cost and are therefore most likely guesthouses, BBs and homestays. As such, small-scale accommodation establishments are highly concentrated in this area.

However, a limitation of this study is the seasonality. Sri Lanka has a high season and low season in the tourism industry. OTA prices for these listings were extracted from October. It is unsure whether these prices would change if the dates were to change as well.

References

1. SLRDA Annual Statistical Report 2016

2. SLTDA Accommodation Guide May to October 2017

3. https://www.cloudbeds.com/articles/analysis-of-major-online-travel-agencies-otas/

(S.S Miththapala if former President of the Tourist Hotels Association of Sri Lanka and can be reached via [email protected]. Sarah Tam is a Graduate Student, University of Waterloo, Canada and can be reached via [email protected].)