Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 21 April 2025 00:35 - - {{hitsCtrl.values.hits}}

Economist Brent Neiman: Charges his formula has been used out of context

Never ending tariff war

Never ending tariff war

The harsh tariff rates imposed by US President Donald Trump on all exporters to USA have squarely hit the poor countries that export mainly items like apparels and rubber products. The list is long, but the main victims are in Asia like Bangladesh, Sri Lanka, Myanmar, Vietnam, and Cambodia. Trump had imposed very high reciprocal tariff rates on these countries because they had been running a trade surplus with USA. Though the tariffs so imposed have been given a pause for 90 days, it has not removed the uncertainty surrounding Trump’s tariff reforms.

The apparel buyers have first asked the exporters to absorb the high tariffs. Since they were unaffordably high, they could not accede to that request. Then, the orders have been cancelled, or placement of new orders have been postponed by buyers until the situation becomes clearer.1 In Sri Lanka, both the apparels and rubber products that had been exported to USA in large volumes have suffered from this pause in buying. Trump has created uncertainty in the global markets by his flip-flop tariff revisions and that has pushed the market participants to keep wondering what will happen next. While small voiceless poor countries are suffering in silence, the large exporters to USA like China, Canada, and EU have chosen to fight’s Trump’s tariff policy with equally unaffordable retaliatory tariff rates. This has led to a never-ending tariff war.

Tariff wars leading to military marches

The economic analyst cum public speaker Dhananath Fernando in a recent webinar2 quoted a statement attributed to American economist Otto T Mallery that if soldiers are not to cross the international boundaries on missions of war, goods must cross them on missions of peace.3 Mallery who had argued for the mutually beneficial economic agreements among nations had also said in this book that ‘unless shackles can be dropped from trade, bombs will inevitably drop from the sky’.4 Prior to Mallery, the 18th century French economist and statesman, Frédéric Bastiat, had also spoken of the benefits of free trade in those lines. Bastiat had questioned the use of having large standing armies and powerful navies in an atmosphere of free trade,5 implying that wars between nations spring up when there are barriers to free trade. He had equated reciprocal tariff to protect one’s industries to a ‘marshes and bogs’ that hinder the free flow of goods.6 When that free flow of goods is blocked, nations will become poorer, and it is that vast poverty leading to economic and social mayhem that will force them to order armies to march across borders.

It would serve two purposes. One is the direction of the fueling anger in local population to an outside enemy. The other is coming out of the economic depression through war related expenditure programs. One could find evidence for this in the World War II that engulfed the world’s nations in 1940s.7 The Great Depression that had hit the world with the crash of the stock markets in 1929 had been worsened by the tariff increases by USA by 20% from 40% to 60% by enacting the Smoot-Hawley Tariff Act of 1930.8 Trump’s tariff regime of 2025 is much harsher than that was introduced in 1930. Hence, the possibility of the present tariff war leading to a globe-wide military conflict between the powerful nations cannot be overruled.

War campaign of King Parakramabahu-I

As I had presented in a previous article in this series,9 an example for the marching of armies across the borders when free trade is blocked can be found from the history of Sri Lanka. Ancient Lanka had been exporting live elephants to other countries to earn valuable foreign exchange because there was a high demand for Lanka’s elephants which were more adapted for use in wars and better than those from mainland India.10 They were exported, in addition to countries in the region like India and Myanmar, to far lands as Egypt. During the reign of King Parakramabahu, I, in the 12th century CE, according to the author of Chulavamsa, Part II of Mahavamsa, elephants had been purchased from Ramangna Desha, present day Myanmar, and the presumption had been that those elephants too had been exported from Lanka.

However, King Parakramabahu, I, had met with a trade issue from the King of Ramangna Desha, called King Arimaddana, who, on the advice of somebody who had gone to his court from Lanka, had unilaterally increased the prices of elephants from 30 silver tickels to 1000 or 2000 silver tickels.11 This export tariff was like fixing a minimum retail price for elephants to be purchased from Ramangna Desha making them too costly and, therefore, uncompetitive for King Parakramabahu, I, to reexport to other countries. Angered by this unilateral weaponisation of tariff by the King of Ramangna Desha, King Parakramabahu, I, had sent an army to invade that country, defeated King Arimaddana and reestablished his source of procuring cheaper elephants.

Trade barriers. A sensitive issue

Trade barriers. A sensitive issue

Tariff and other trade barriers, imposed whether on inward or outward goods, is a sensitive issue that could end in wars between countries. Japan invaded Southeast Asia during the World War II to secure access to oil and rubber which had been under the control of colonial powers like the Dutch and the British.12 Thus, it is inevitable for soldiers to cross the borders in destructive military actions when goods do not cross them freely. The enormous costs which the World War II, an offspring of the deteriorated economic conditions brought about partly by high tariffs and trade barriers, had inflicted on the global political as well as economic landscape had been felt by the world for decades even after the end of the war in 1944. This is a warning for the present-day warriors in a tariff war.

Reciprocal tariff, only tip of iceberg

It seems that Sri Lanka’s President and his Cabinet, opposition members, and top policymakers are of the narrow opinion that the impact of Trump(dis)order is limited to the reciprocal tariff of 44% that has been imposed on Sri Lanka. Hence, their time, energy, and efforts are being utilised for the single goal of getting the US administration to change from a universal tariff of 44% to an HS-Code based tariff structure. While it serves Sri Lanka to address the immediate issue of the Trump shock delivered to the country’s major exports to USA, the problem which the country might face in the medium to long-run is much bigger than this. Trump’s tariff policy will cause inflation to accelerate in USA reducing the real purchasing power of Americans in the first instance. It will also cause the US economy to grow slowly or move into a recession reducing the real purchasing power of Americans in a second round. Sri Lanka exports mass-produced consumer items to USA and the lowered real purchasing power of US citizens will hit very badly the country’s export goals. But the bigger problem faced by the global community is the retaliatory tariff imposed on US imports by the world’s main economic powers, namely, China, and the European Union reinforced by other partner countries like Canada and Mexico. This group plus USA accounts for about 54% of the global GDP. These retaliatory tariffs will shrink their economies too. Eventually, Sri Lanka’s exports will face a gloomy export market hitting its export sector in a second round. The country should prepare itself for this eventuality.

Two issues with tariff revisions

I have two issues with Trump’s tariff revision plan. One relates to his wrong interpretation of the trade deficit which USA is having with most of its trading partners. The other is the irrelevant and misleading formula he has used to calculate the magnitude of the amount alleged to have been robbed from US citizens by countries which have a trade surplus with USA.

Wrong reading of trade deficits

Trump has claimed that the trade surplus which many countries have with USA is an indicator of the extent of plundering of US citizens by those countries through higher tariff rates. As I have pointed out in a previous article in this series,13 USA being the unofficial central banker nation to the world since 1971 has been able to command real goods from the rest of the world by exchanging a worthless piece of paper called the dollar. If that dollar returns to USA, the holder is promised that he could get a basket of real goods and services worth one dollar. If it is circulated as a reserve currency through the globe, the holder can command a dollar’s worth of real goods and services from the rest of the world.

But these two promises are broken if the domestic value of the dollar falls due to domestic inflation in USA, on one side, and the fall in the international value of dollar due to loss of trust about the issuer of the dollar, namely, the US government, on the other side. USA’s Consumer Price Index or CPI which stood at 100 in 1982-4 has increased to 313 in March 2025 meaning that a dollar in 1982 is worth only 32 US cents today. The international value of the dollar should be gauged by reference to the price of gold since gold is the best substitute asset for the dollar. In 1982, a fine ounce of gold was traded at $ 376 in the world markets. The price of same gold has sharply increased to $ 3238 in March 2025, implying that a dollar’s value in the international markets in 1982 has fallen to 12 US cents. Hence, a foreigner who has acquired a dollar in 1982 by sacrificing a dollar’s worth of a real good or service has been condemned to hold a worthless piece of paper today. Therefore, by having a trade deficit with other countries, it is the US citizens who have looted from the citizens of those countries. Hence, instead of punishing them, Trump administration should compensate them.

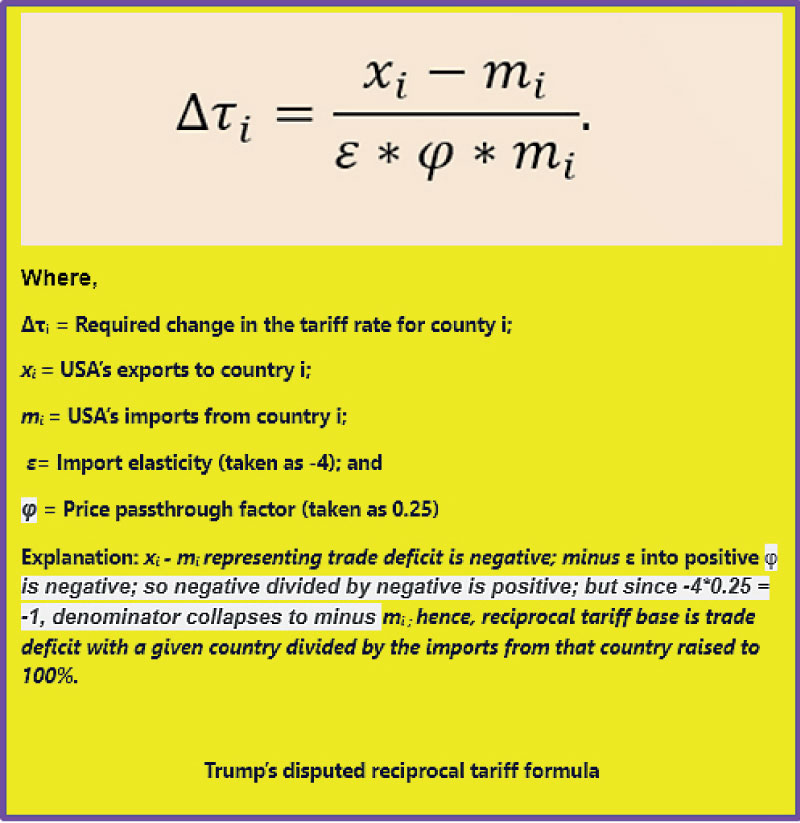

Use of irrelevant formula

The formula used by Trump’s policy advisors to calculate the extent of the amount plundered by the countries with a trade surplus with USA is irrelevant for the purpose. It simply says that the percent of the amount so plundered is equal to the trade deficit which USA has with those countries is proportionate to the amount which USA has imported from them assuming that the import elasticity of US demand times the price adjustment in US market is equal to 1. To arrive at this result, Trump’s policy advisors have used a general import elasticity of 4 and a price adjustment factor of 0.25. These are two strange numbers since the same have been used for both consumer items like apparels, essential items like chips and pharmaceuticals, and discretionary items like components for producing military items or aircraft. Naturally, this formula fails when it is applied to countries with a trade surplus with USA. Since the trade deficit is a negative number, and it is divided by a negative import elasticity, the outcome is a positive number. But when it is applied to countries with a trade surplus like UK, Singapore, Australia, or the Netherlands, the outcome is a negative number meaning that USA should compensate them for the amount it has plundered from them.

Dispute of formula by a co-author

The formula used by Trump’s policy advisors has been disputed by its co-author, Brent Neiman, Edward Eagle Brown Professor of Economics at the Booth School of Business of the University of Chicago in a recent interview with Erin Burnett of CNN.14 Neiman says that the policy advisors have taken the purpose and meaning of the formula out of context. The purpose of the formula was to identify how a country could determine the appropriate tariff rate to balance a trade gap when there is a difference in tariff rates by about 3 to 4%. It is not a formula to be used on a mass scale for countries. For instance, to a query by Burnett, he confirmed that it is not a formula to be used for a country like Sri Lanka which exports a lot of apparels but does not buy sufficient turbines from USA. According to him, the application is totally wrong because even if Sri Lanka goes for zero tariff for the imports from USA, the trade gap cannot be eliminated. He also confirmed that the actual price adjustment factor should have been not 0.25 used by Trump’s policy advisors, but 0.95. When that factor is applied, the US’s imports from the respective country should by multiplied by 3.8 and not by 1 as had been done by Trump’s policy advisors. In that scenario, all the calculations made by Trump’s policy advisors to impose the reciprocal tariff on trade surplus countries collapse on itself. For instance, Sri Lanka’s alleged plundering of Americans is reduced from 88% to 23%.

Trump for the moment has paused the reciprocal tariff for 90 days. It is prudent on his part if he withdraws it completely after the lapse of the stipulated 90-day period.

Footnotes:

1https://www.tbsnews.net/world/global-economy/panic-grips-worlds-factory-hubs-after-trump-tariff-whiplash-1114681

2https://youtu.be/6gDK3r1XrpE?si=ybhv1ALaprIht5oL

3Mallery, Otto T, 1943, Economic Union and Durable Peace, Harper and Brothers, p 10.

4Ibid.

5Bastiat, Frédéric, Economic Sophism, (Arthur Goddard, tr) FEE, New York, First Series, Chapter 5, (available at: https://oll.libertyfund.org/titles/hazlitt-economic-sophisms-fee-ed ).

6Ibid, Chapter 10, Reciprocity.

7https://grademiners.com/examples/how-did-the-great-depression-lead-to-wwii

8https://www.strongandherd.co.uk/the-smoot-hawley-tariff-act-lessons-from-history-and-its-relevance-today#:~:text=The%20bill%20was%20signed%20by,weren’t%20factored%20into%20this.

9https://www.ft.lk/columns/Trump-s-misfiring-trump-card-weaponising-tariffs-and-immiserating-own-citizens/4-773106

10Bandara, Ranjith and Tisdell, Clem, 2005, History and Value of the Elephant in Sri Lankan Society, Working Paper 133, The University of Queensland, p 8

11Mahavamsa Part II, Mudliyar L C Wijesinha Translation, 2000, Asian Educational Services, New Delhi, page 229.

12https://afe.easia.columbia.edu/special/japan_1900_power.htm#:~:text=The%20Japanese%20military%20saw%20another,Europeans%20who%20were%20now%20busy

13https://www.ft.lk/columns/Trump-dis-order-is-to-hit-Sri-Lanka-very-badly-with-limited-options-available/4-775230

14https://youtu.be/XTwNUl-v57s?si=BQ3PX014mrwXiNJQ

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)